Forex Trading 101: What Every Beginner Should Know

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies on the foreign exchange market. It is one of the largest and most liquid financial markets in the world, with an average daily trading volume of over $5 trillion. If you are new to forex trading, it can seem overwhelming at first. However, with the right knowledge and strategies, you can become a successful forex trader. In this article, we will cover the basics of forex trading and provide you with the information you need to get started.

What is Forex Trading?

Forex trading involves the simultaneous buying of one currency and selling of another. Currencies are traded in pairs, such as EUR/USD or GBP/JPY. The value of a currency pair is determined by the exchange rate between the two currencies. For example, if the exchange rate for the EUR/USD pair is 1.20, it means that 1 euro is equal to 1.20 US dollars.

Forex trading takes place in the over-the-counter (OTC) market, which means that trades are conducted directly between buyers and sellers without a central exchange. This gives traders the flexibility to trade 24 hours a day, five days a week, as the forex market operates across different time zones.

How Does Forex Trading Work?

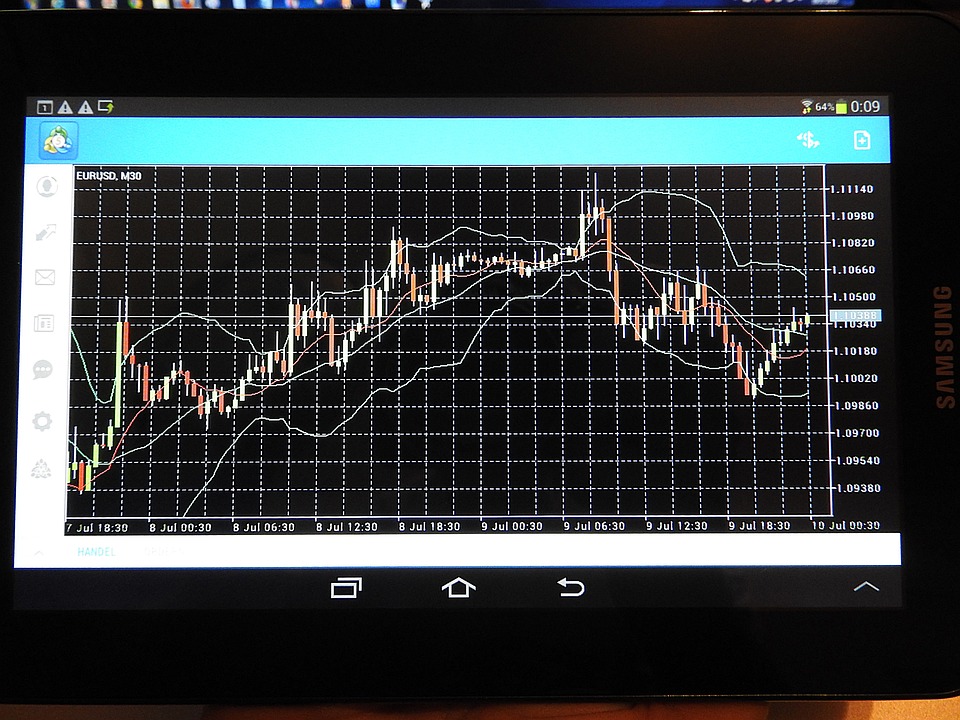

Forex trading involves speculating on the price movements of currency pairs. Traders can profit from both rising and falling markets by going long (buying) or short (selling) a currency pair. To place a trade, traders use a trading platform provided by a broker, which allows them to execute trades, analyze charts, and manage their positions.

When you open a trade, you are essentially borrowing one currency to buy another. The goal is to sell the borrowed currency at a higher price than you paid for it. If the price moves in your favor, you can close the trade and take a profit. However, if the price moves against you, you may incur a loss.

Key Concepts in Forex Trading

Before you start trading forex, it is important to understand some key concepts that will help you navigate the market:

- Leverage: Leverage allows traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it also increases the risk of losses.

- Lots: A lot is the standard unit size of a forex trade. There are different lot sizes, such as standard lots, mini lots, and micro lots.

- Pips: A pip is the smallest price movement in a currency pair. Most currency pairs are quoted to four decimal places, so a one-pip movement would be 0.0001.

- Margin: Margin is the amount of money required to open a leveraged position. It acts as a deposit to cover potential losses.

Risks and Rewards of Forex Trading

Forex trading offers the potential for high profits, but it also carries a high level of risk. It is important to be aware of the risks involved in forex trading, such as market volatility, leverage, and geopolitical events that can impact currency prices. To mitigate these risks, traders can use risk management strategies, such as setting stop-loss orders and limiting the amount of leverage used in trades.

On the flip side, successful forex traders can enjoy the rewards of trading, including the ability to profit from market fluctuations, diversify their investment portfolio, and trade in a highly liquid market.

FAQs

1. What is the best time to trade forex?

The best time to trade forex is when the market is most active, which is during the overlap of the London and New York trading sessions. This is when the highest trading volume occurs, leading to tighter spreads and increased liquidity.

2. How much money do I need to start trading forex?

The amount of money you need to start trading forex depends on the broker you choose and the leverage you use. Some brokers offer micro accounts that allow you to trade with as little as $100.

3. What is a demo account?

A demo account is a practice account that allows you to trade forex with virtual money. It is a great way for beginners to learn how to trade without risking any real capital.

4. How do I choose a forex broker?

When choosing a forex broker, consider factors such as regulation, trading platforms, customer support, and trading costs. It is important to choose a reputable broker that meets your trading needs.

5. What is technical analysis?

Technical analysis is a method of analyzing price charts to predict future price movements. It involves studying historical price data, chart patterns, and technical indicators to identify trading opportunities.

6. What is a stop-loss order?

A stop-loss order is an order placed with a broker to close a trade at a predetermined price level. It is used to limit losses and protect your capital in case the market moves against you.

7. Can I trade forex on my mobile phone?

Yes, many brokers offer mobile trading apps that allow you to trade forex on your smartphone or tablet. This gives you the flexibility to trade on the go and stay connected to the market at all times.

8. How can I learn more about forex trading?

To learn more about forex trading, you can take online courses, read books and articles, and practice trading on a demo account. It is important to continue learning and improving your trading skills to become a successful forex trader.

For more information on forex trading for beginners, check out this comprehensive guide on Forex Factory.