Decoding Forex Quotes: What You Need to Know to Succeed in the Market

Forex trading can be a complex and confusing world for beginners. One of the first things you will encounter when trading in the forex market is forex quotes. Understanding how to decode forex quotes is crucial for success in the market.

What are Forex Quotes?

Forex quotes are the prices at which currencies are traded in the forex market. They consist of two prices: the bid price and the ask price. The bid price is the price at which you can sell a currency pair, while the ask price is the price at which you can buy a currency pair.

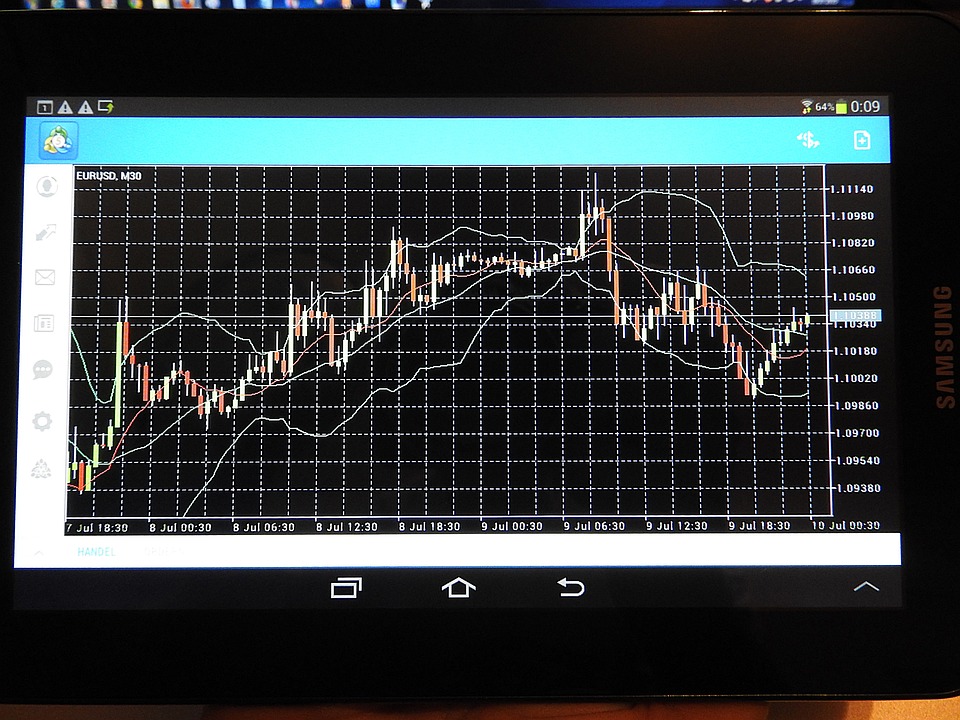

Forex quotes are typically displayed in a format that includes the currency pair, the bid price, and the ask price. For example, EUR/USD 1.1000/1.1005. In this example, EUR/USD is the currency pair, 1.1000 is the bid price, and 1.1005 is the ask price.

Understanding the Bid-Ask Spread

The difference between the bid price and the ask price is known as the bid-ask spread. This spread represents the cost of trading in the forex market and is an important factor to consider when making trading decisions. A smaller spread indicates a more liquid market, while a larger spread indicates a less liquid market.

Factors Affecting Forex Quotes

Forex quotes are influenced by a variety of factors, including economic indicators, geopolitical events, and market sentiment. Understanding these factors can help you make more informed trading decisions.

Some common factors that can affect forex quotes include interest rates, inflation, political stability, and economic growth. By staying informed about these factors, you can better predict how forex quotes may move in the future.

How to Read Forex Quotes

When reading forex quotes, it’s important to remember that the first currency listed is the base currency, while the second currency is the quote currency. The bid price represents how much of the quote currency you will receive for one unit of the base currency, while the ask price represents how much of the base currency you need to buy one unit of the quote currency.

For example, if you see the quote EUR/USD 1.1000/1.1005, this means that you can sell one euro for 1.1000 US dollars, or buy one euro for 1.1005 US dollars.

Commonly Used Forex Quote Terminology

There are several terms that are commonly used when discussing forex quotes. Some of these terms include:

- Pip: A pip is the smallest unit of price movement in the forex market. It is typically equal to 0.0001 for most currency pairs.

- Spread: The spread is the difference between the bid price and the ask price of a currency pair.

- Leverage: Leverage allows traders to control larger positions with a smaller amount of capital.

FAQs

1. What is a currency pair?

A currency pair is a pair of currencies that are traded in the forex market. It consists of a base currency and a quote currency.

2. What is the bid price?

The bid price is the price at which you can sell a currency pair in the forex market.

3. What is the ask price?

The ask price is the price at which you can buy a currency pair in the forex market.

4. What is the bid-ask spread?

The bid-ask spread is the difference between the bid price and the ask price of a currency pair.

5. How do economic indicators affect forex quotes?

Economic indicators can influence forex quotes by providing insights into the health of a country’s economy.

6. What is leverage in forex trading?

Leverage is the ability to control a larger position with a smaller amount of capital in forex trading.

7. What is a pip in forex trading?

A pip is the smallest unit of price movement in the forex market.

8. How can I stay informed about factors affecting forex quotes?

You can stay informed about factors affecting forex quotes by following economic news, geopolitical events, and market analysis.

For more information on decoding forex quotes, check out this comprehensive guide.